Cryptocurrencies regulation Explained: How are cryptocurrencies regulated in countries around the world?

Cryptocurrencies regulation Explained: With the purpose of “providing a favorable environment for the Reserve Bank of India to issue an official digital currency,” the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, will be introduced in Parliament’s Winter Session, which begins on November 29.

“The law proposes to ban all private cryptocurrencies in India, with limited exceptions to encourage cryptocurrency’s fundamental technology and usage,” according to the bill.

As soon as the news broke, cryptocurrency values on local exchanges fell, despite global markets staying largely unchanged.

According to industry sources, cryptocurrency investors are panicking and selling their holdings in anticipation of a ban or restriction. In India, cryptocurrencies are currently unregulated and unrestricted; nevertheless, government efforts to define and regulate virtual currencies vary greatly among areas.

How are cryptocurrencies regulated in countries around the world?

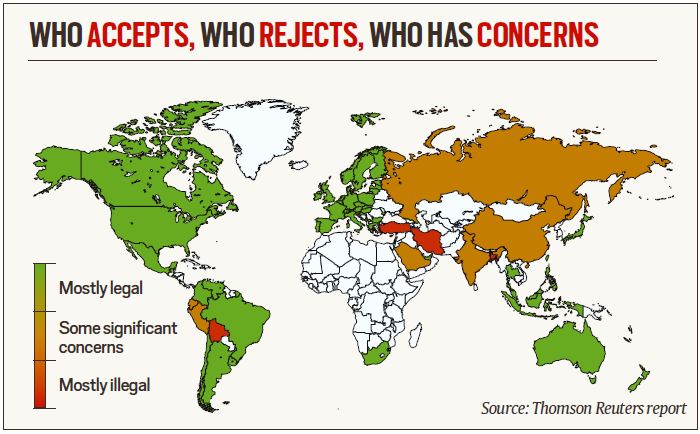

Countries and regulators have adopted a range of attitudes on virtual currencies, ranging from outright bans to allowing them to function under certain limits to allow them to trade freely.

Governments and authorities are debating whether bitcoin should be recognized as a currency or an asset, as well as how it should be controlled. Policy and regulatory responses have been radically disparate, with no cross-national cooperation.

Source: Thomson Reuters report

Source: Thomson Reuters report

As already stated, regulatory and legal reactions can range from total transparency, as in El Salvador, where bitcoin has been approved as legal tender, to a broad onslaught, as in China, which has imposed severe restrictions on both cryptocurrencies and network operators.

After a phase of legal and regulatory experimentation, countries like India are figuring out the best way to handle cryptos. As conversations progress, the United States and the European Union have stayed consistent in their efforts to define the regulatory mission.

Read| Top 10 Altcoins (Best Cryptocurrencies Other Than Bitcoin)

Some countries have acknowledged and defined these currencies but have yet to enact legal legislation.

The Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations in Canada, for example, describe virtual currency as:

(a) an anti-digital representation of value that can be easily swapped for cash or another virtual currency after being utilized for sale or investment.

(b) in a cryptographic system, a person’s or entity’s private key allows them to access the digital representation of value indicated in paragraph

Canada was one of the early users of cryptocurrencies, according to research released in June by the Thomson Reuters Institute, and the Internal Revenue Service (CRA) considers bitcoin to be a qualifying resource for a developing country’s income tax.

Israel: Virtual currencies are included in the definition of financial assets in ISRAEL’s Supervision of Financial Services Law. Bitcoin has been recognized as a security by the Israeli Securities Authority, while cryptocurrency has been classified as an asset by the Israel Tax Authority, which has levied a 25% capital gains tax.

Germany: Virtual currencies are defined as “units of account” and hence “financial instruments” by Germany’s Financial Supervisory Authority. Bitcoin is classified as a crypto token by the Bundesbank since it does not perform the functions of money. On the other hand, citizens and legal entities can purchase and sell cryptocurrencies through exchanges and custodians approved by the German Federal Financial Supervisory Authority.

THE UNITED KINGDOM: While Her Majesty’s Revenue & Customs does not consider cryptocurrencies to be cash or money, they do have their own identity and hence cannot be compared to any other type of investing activity.

United States: IN THE UNITED STATES, CRYPTOCURRENCIES HAVE DIFFERENT DEFINITIONS AND REGULATIONS. Despite the fact that the federal government does not accept cryptocurrencies as legal tender, state definitions recognize their decentralized nature.

Thailand: Digital asset businesses in Thailand are required to apply for a license, monitor for unfair trading practices, and are categorized as “financial institutions” for anti-money laundering purposes, according to research released by the Thomson Reuters Institute. Thailand’s oldest bank, Siam Commercial Bank, said earlier this month that it will purchase a 51 percent stake in local cryptocurrency exchange Bitkub Online.

While most of these countries do not accept cryptocurrencies as legal tender, they do acknowledge the value they represent — and its functions as a medium of trade, unit of account, or store of value — (any asset that would normally retain purchasing power into the future).

Read| Crypto Bill: Government’s proposed to ban private cryptocurrencies in India, allow RBI digital coin

How would a Central Bank Digital Currency (CBDC) work?

The Reserve Bank of India (RBI) intends to build the CBDC, a regulated digital version of fiat money that may be exchanged via blockchain-based wallets. Despite the fact that the concept was inspired by Bitcoin, CBDCs differ from decentralized virtual currencies and crypto assets, which are not issued by the government and do not have the government’s ‘legal tender’ status.

CBDCs allow customers to make domestic and cross-border transactions without using a third party or a bank. Given that other nations are conducting pilot projects in this area, India will need to build its own CBDC if the rupee is to compete in international financial markets.

CBDC is a digital or virtual currency, but it differs from the private virtual currencies that have proliferated in recent years.